Background

The Chinese government has approved the establishment of China RailwayCorporation to perform the commercial functions of the defunct Ministry of Railways as part of the cabinet restructuring plan.

The company has been set up with registered capital of 1.04 trillion yuan ($165 billion) which was provided by the Ministry of Finance and will be administered by the central government and supervised by the Ministry of Transport (MOT) and the future State Railways Administration (SRA), the other new institution to be formed as a result of the dismantling of the MOR.

The related assets, debts and personnel of the previous MOR will be transferred to thecorporation, while the interests and rights of 18 local railway administrative bureaus, three transport companies and the rest companies will also be added to the corporation.

Debt

There are still many unanswered questions about how the new company will deal with the large amount of liabilities that it is expected to inherit from the MOR.

Data provided by the railway authorities indicates that, by the end of the third quarter last year, the MOR held 4.3 trillion yuan in assets, while debts came to almost 2.7 trillion yuan – a leverage ratio of 62 percent. Sheng Guangzu said in an interview that “We should separate out the railway construction debt into that of a public welfare nature and those related to business operations. The CRC and the state will carefully study this and we ask people to not worry.”

Given the amount of debt that the new company is expected to inherit from the former MOR, the central government has said that they will not require the company to pass on a percentage of its profits to the state for the time being.

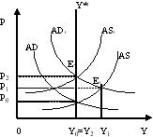

Price

As the new “China Railway Corporation” runs commercial operation, the price would be decided by the market demand and supply instead of administrative decision. This marketing reform would tremendously weaken the right of government by reducing the government rent-seeking behavior.

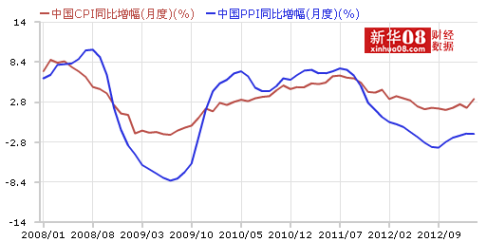

Some have predicted the debts built up by the now-defunct Railways Ministry will lead to a rise in prices. If so, this may increase railway fright cost and even elevate the overall price level. However, some has stated that the pricing scheme should be concerned with both the sector’s normal operation and development, as well as the daily traveling and vital interests of the general public.

New era

The reform was in response to public criticism over the fact the Railways Ministry was both a policymaker and service provider. The establishment of the China Railway Corporation is a significant act in the deepening of the reform of railway management system, of separating government functions from business and promoting the sustainable development of railway construction and operation. Thus, the new “China Railway Corporation” will face the problem encountered by other state-owned enterprises, such as unclear property rights, unknown responsibilities and rights and invalid incentives. And like other state-owned enterprises, it will figure out how to establish modern corporation system, how to improve efficiency and effectively reduce internal managerial cost.